cumulative preferred stockholders have the right to receive

Cumulative preferred stock is a class of shares wherein any unpaid or undeclared dividends for the current year must be accumulated and paid for in the future. D Cumulative preferred shares have the right to receive any dividends not paid.

3 Levels Of Project Quality Because Quality Costs Money Infographic Projectmanagement Infographic Social Media Software Change Management

The shares are convertible into 2 shares of common stock.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-1147352047-8351b4dd1d63436baa146aa1b3441b96.jpg)

. The cumulative feature of preferred stock may not give the preferred stockholders the right to receive current-year dividends and unpaid prior-year dividends before common stockholders receive any dividends. Pages 60 Ratings 100 2 2 out of 2 people found this document helpful. With cumulative preferred stock the company must keep track of the dividends it chooses not to pay to its preferred shareholders.

Cumulative preferred stockholders enjoy a promise that missed dividends will accumulate and be paid later before any dividends are paid to common stockholders. The dividends will keep getting accrued till they are paid. The INR 60 per share dividend arrears before paying the INR 20 per share dividend for this quarter.

By contrast if a company issues noncumulative preferred stock its preferred shareholders have no future right to receive dividends that the company chooses not to pay. 00 with the expectation of receiving the 050 dividend it must be worth that amount less the dividend amount when the right to receive. This type of preferred stockis oled Cumulative preferred.

Cumulative preferred stockholders have the right to receive dividends in arrears when dividends are subsequently declared. Normally the common stockholders have to be patient until all the. A participating feature gives preferred shareholders the right to receive a share of dividends paid to common shareholders.

This category of shareholders is entitled to dividends for a particular year regardless of the fact that the company has declared dividends for the particular year or not. When a corporation is not able to pay dividends for a particular year they get accrued. If preferred stock is designated as cumulative the suspended dividends accumulate and you must later pay them in full.

Course Title ACCOUNTING 101. You may retain the right to suspend payment of dividends. Preferred stockholders have the right to receive dividends to strears those not paid in prior years promised prior to common stock dividends being paid.

However such stocks are costlier do not have voting rights and cannot demand interim dividends. A cumulative preferred stock is a type of preferred stock wherein the stockholders are entitled to receive cumulative dividends if any dividend payment is missed in past. Any remaining funds will then be paid out to the 5 and 9 noncumulative preferred stockholders.

The cumulative preferred stock shareholders must be paid the 900 in arrears in addition to the current dividend of 600. Cumulative preferred stock is preferred stock for which the right to receive a basic dividend accumulates if the dividend is not paid. Cumulative Preferred stockholders get a fixed dividend rate irrespective of the profit.

The company will have to begin by paying the cumulative dividends to the cumulative preferred stockholders. If the preferred stock is cumulative preferred shareholders have the right to receive all back dividends that were not paid before any cash dividends may be paid to common stockholders. Cumulative preferred stockholders enjoy the first right to purchase any new shares of stock issued by the firm.

Preferred stock shareholders already have rights to dividends before common stock shareholders but cumulative preferred shares contain the provision that should a company fail to pay out dividends at any time at the stated rate then the issuer will have to make up for it as time goes on. In the case of a missed payment the holders from the cumulative Preferred Stock receive all the payments of dividends in the arrears prior to the shareholders getting a payment. Once all cumulative shareholders receive.

One of these rights may be the right to cumulative dividends. The common stock price at the time of the issuance is 9 a share. The participating preferred shareholders would receive 10 million but also would be entitled to 20 of the remaining proceeds 10 million in this case 20 x 60 million -.

Cumulative preferred stocks right to receive dividends is forfeited in any year that dividends are not declared. Cumulative Preferred Stocks are considered one of the most popular equity financing sources for the company. They have the following salient features.

By contrast if a company issues noncumulative preferred stock its preferred shareholders have no future right to receive dividends that the company chooses not to pay. Because cumulative preference shareholders are entitled to receive dividends on a regular basis including earlier payouts that were missed the corporation would have to settle all unpaid dividends ie. However noncumulative stocks undeclared dividends accumulate each year until paid.

This is when things start to get interesting. With cumulative preferred stock the company must keep track of the dividends it chooses not to pay to its preferred shareholders. D cumulative preferred shares have the right to.

Priority preferred Preemptive preferred Dividends are not paid 10 preferred stockholders.

Preferred Stock Explained 6 Types Of Preferred Stock 2022 Masterclass

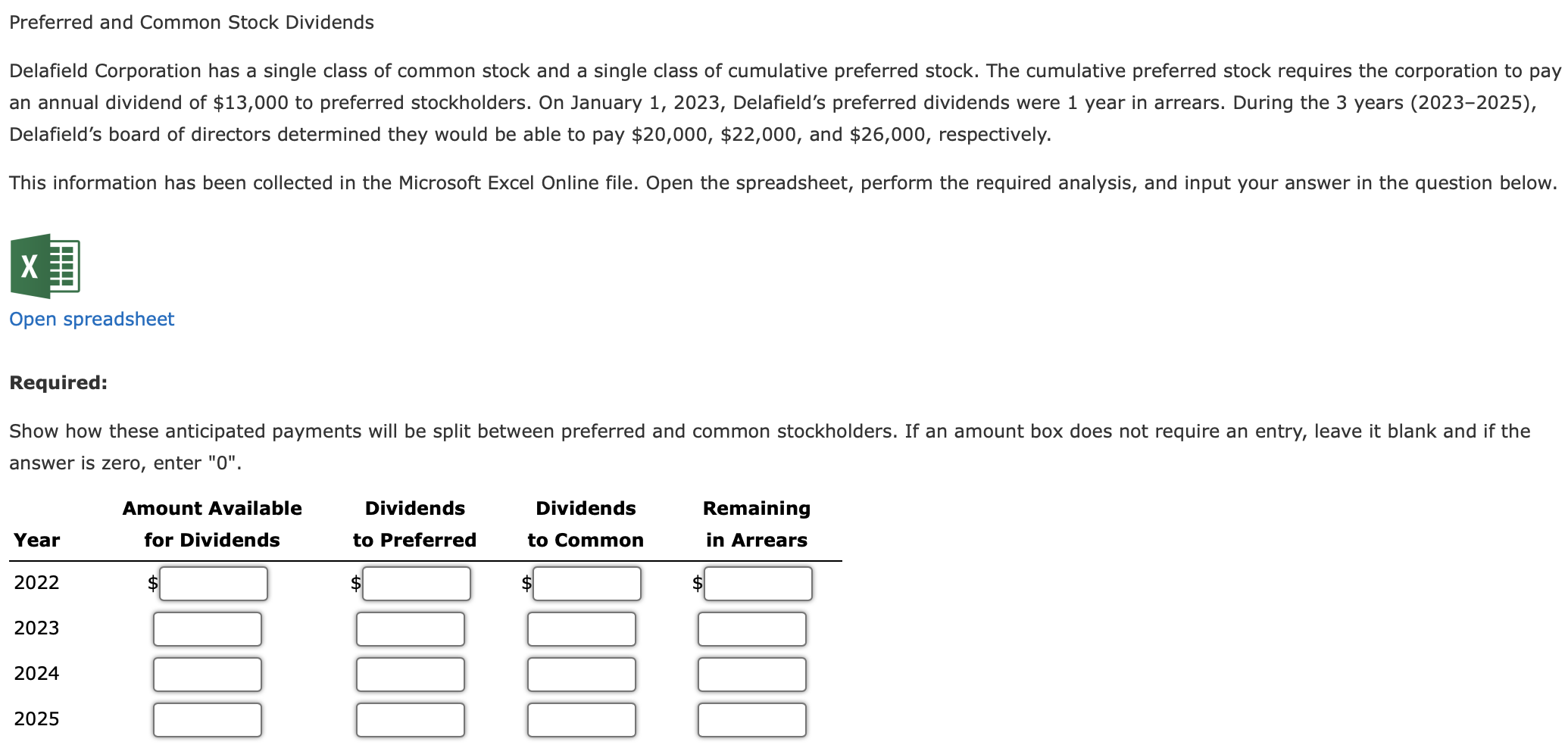

Solved Preferred And Common Stock Dividends Delafield Chegg Com

Arrearages Meaning Example Uses And More In 2022 Accounting And Finance Financial Management Meant To Be

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-1147352047-8351b4dd1d63436baa146aa1b3441b96.jpg)

What Is Perpetual Preferred Stock

What Is A Preferred Stock And How Does It Work Ramseysolutions Com

What Is Preferred Stock Is It Right For My Portfolio Nerdwallet

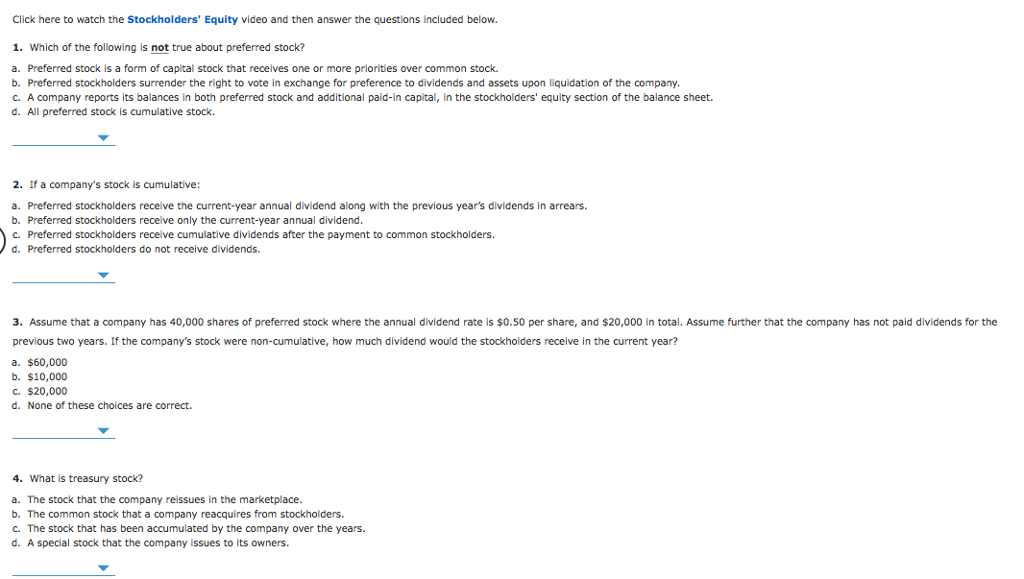

Solved Click Here To Watch The Stockholders Equity Video Chegg Com

Common Stock Vs Preferred Stock A Guide Equitynet

What Is Cumulative Preferred Stock Abstractops

The Difference Between Common And Preferred Stock Abstractops

I Don T Understand Preferred Dividends Now What

How To Calculate Preferred Dividends From The Balance Sheet Sapling

Cumulative Preferred Stock Definition

Preferred Stock Law Office In Israel 03 3724722

Preferred Stocks Explained Seeking Alpha

What Is Preferred Stock Definition Pros Cons Thestreet

Which Of The Following Typically Applies To Common Stock But Not To Preferred Stock In 2022 Common Stock Preferred Stock How To Apply

Cumulative Preferred Stock Definition Business Example Advantages

How To Calculate The Price Of Preferred Stock For A Startup Abstractops